You Are Not Alone it Just Feels That Way

Are you a 10? Of course you are! But maybe you feel more like a 6.3 when it comes to your overall emotional and financial well-being. If so, you are not alone. According to a recent Guardian Life study, most Americans--79%, in fact--feel this way. Here are some of the big things knocking around in everyone’s mind:

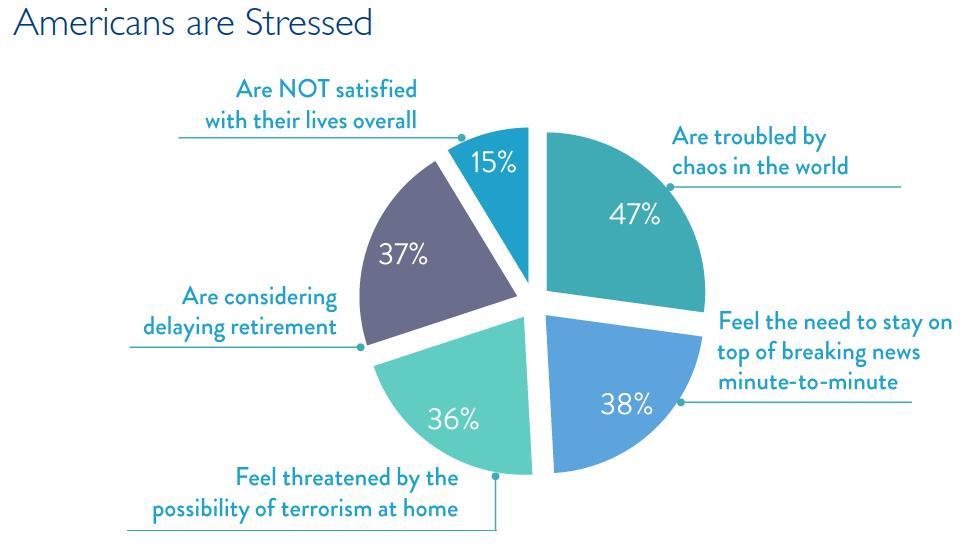

Exhausting. There are so many stressors coming at us every day. On one end, for example, nearly half of those surveyed--47%--“are troubled by chaos in the world.” On the other end, 37%--over a third--“are considering delaying retirement.” Check it out:

That’s a lot of stress. But buried in here is a critical insight: Though you can’t control “chaos in the world,” you can control your personal financial decisions. And once you can better control your personal financial decisions, your feelings about chaos in the world are likely to cause you less stress.

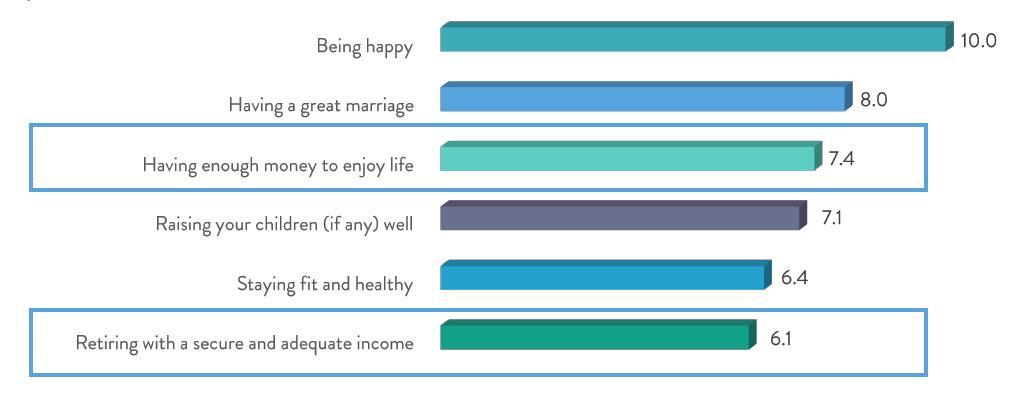

See how that works? It has to do with something called priorities. Yes you’ve heard of them before, and you will hear of them again. Priorities = good. For the Americans we surveyed, “being happy” is right at the top. But not too far off is “having enough money to enjoy life” and “retiring with a secure and adequate income.”

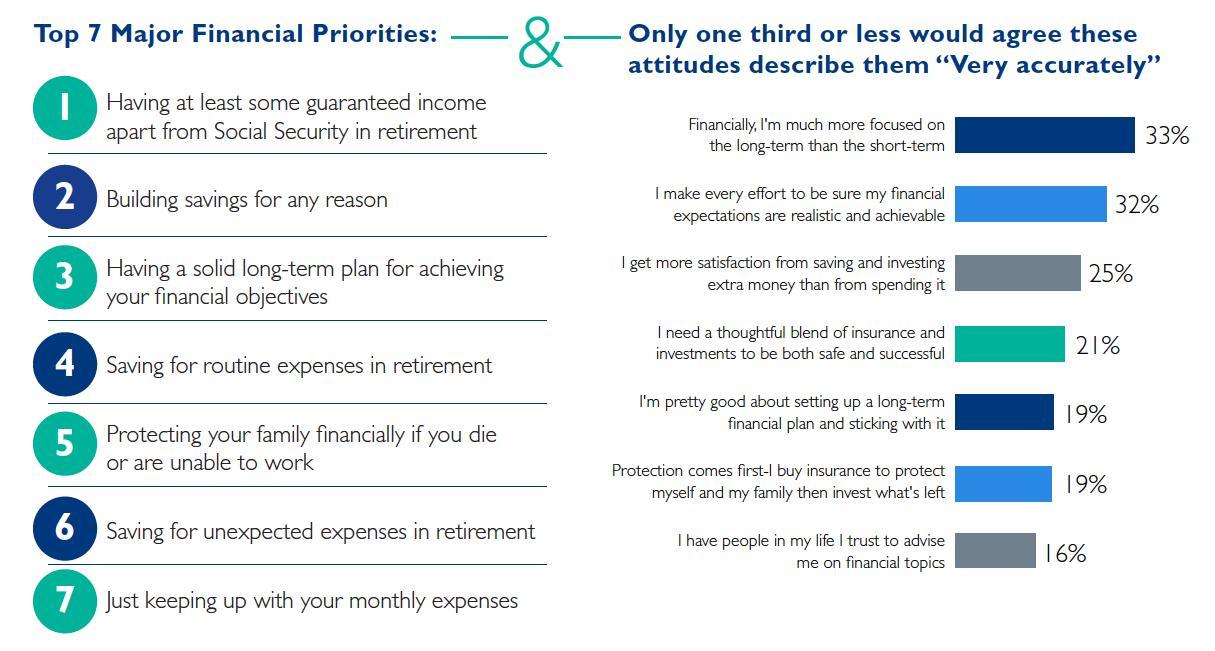

At first, it might sound far-fetched, but, in fact, the way you feel about your financial well-being influences your overall outlook on everything. So why isn’t everyone doing it? Apparently there’s a gap between financial priorities (there they are again) and behaviors. The greatest financial priority for those surveyed is “having at least some guaranteed income in retirement.” Yet only 19% are “pretty good at setting up a long-term financial plan and sticking with it.”

See the disconnect? So how can you ratchet up that overall financial and emotional well-being number to a 10? It’s about getting those priorities and attitudes to sync up with model behaviors. These are the actions you can take to get where you really want to be. So, go ahead and click here to download the full report that lays out the model behaviors you can adopt. It’s completely free; you don’t even need to provide your email address.

Wow. You’re looking more like a 10 already.

Data source: Guardian's 2016 Living Confidently Survey.

Brought to you by The Guardian Network © 2017. The Guardian Life Insurance Company of America®, New York, NY.